Digital payments power the vast majority of business interactions. Our study found that families expect the same thing from their students’ schools, yet districts are not aligning with the wants and needs of their families.

In 2023, our team conducted a national survey to gauge expectations and preferences associated with the mediums through which education systems conduct business. We talked to 1,000 participants aged 18 to 65 from different genders, ethnicities, financial, and generational backgrounds.

One concrete conclusion from this study is that most Americans believe paying with paper-based processes is slow and outdated. They would like to see these methods digitized. One of the easiest ways for districts to meet this new expectation is by making digital payments an option for families.

Why paper-based transactions don’t meet expectations

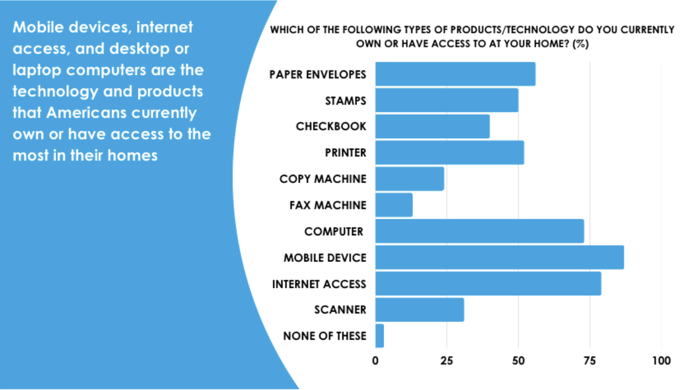

Over the last decade, access to and reliance on digital technology has substantially increased. Our study has shown more Americans have access to mobile devices, computers, and the Internet than paper-based technology like printers, copy machines, fax machines, and scanners.

Here you can see a visual breakdown of this particular finding:

People conduct most of their personal and professional business with modern electronics—making paper-based practices obsolete. Therefore, when districts don't offer digital solutions, they position themselves as outdated and not accommodating to their community members who have the most access to digital technology.

The fact is communication and payment methods enable a swift and secure exchange of information. Families have come to expect these options everywhere. In most cases, they depend on the flexibility of paying with a mobile phone.

Without mobile options, guardians must take time off work, secure transportation, and pay an extra fee to print, fax, or mail documents. Far too much effort for something that could be done digitally in a fraction of the time. Working guardians deserve to spend their time and resources with their children—not jumping through unnecessary hurdles to conduct business with their school administration.

What are the trends in mobile payment systems?

Approximately 114 million Americans have reported making a mobile transaction. This incredible number demonstrates how paying without cash or a check is becoming the norm. As younger generations have grown up with digital solutions, they expect online payments to be an option.

According to our Communications with Education Systems Study:

-

63 percent of Americans believe they will not have to use a checkbook within five years.

-

46 percent of Americans believe they will not have to use cash within five years.

-

44 percent of Gen Z are not confident they could write a check.

-

73 percent of Americans think emerging generations will demand all their interactions with the government be through mobile devices.

There are guardians and parents your district serves who are from younger generations, and as you can gather from the statistics above, paper-based technology is being phased out of their lives.

The majority of Americans don't even think they'll be using cash or checks in the next five years, and 59 percent would like to never send something in the mail again.

Any institution requiring people to do as much does not consider its community's needs. Families aren't the only ones who feel this way. School and district staff have also expressed their preference to transition to digital processes.

Our research shows 56 percent of school district members consider reliance on paper-based transactions to be a thing of the past. Over the next 2 to 3 years, most Americans would prefer to pay for things online.

Your district should take that timeframe to research and implement a secure and easy-to-use digital payment system. Families and staff have expressed their desire for this change—they want to move forward, not backward. The transition to digital processes will only become more cumbersome as paper records continue to build up.

What are the objections to mobile payments?

School districts haven't universally adopted digital payments because some objections remain to cashless methods—mainly around security and accidental payments.

However, if fraudulent activity occurs on your credit card or debit card, fraudulent liability is minimized, if not completely eliminated. In addition, as more consumers use digital payment methods, card consortiums build up data that allows card issuers to learn more about how fraud happens. What’s more, paper checks are one of the least secure methods of invoice payments available due to their physical nature, which often requires the exposure of personal and financial information to multiple people before a final deposit.

In addition, digital transactions offer audit trails and safeguards against fraudulent activity or incorrect payments not always available with paper-based payment methods.

Moving to a digital payment option can be scary for those who have always relied on manual or paper payment methods. However, the security and protection plans associated with digital wallets provide reliable safeguards that do a wonderful job of preventing cases of fraudulent activity and fixing incorrect payments.

Mobile payments are safe and recommended

Digital payments are quick, painless, and, most of all, protected. Since mobile devices transfer data over secure cellular networks that are automatically encrypted without manual security settings, the connection is safer than wifi connections without the same default protection.

Smartphones also have mobile wallets, which store payment information and allow users to pay with an app instead of a physical card. Digital wallets have advanced safety features that make them exponentially more difficult to compromise. Many vendors have started to accept digital payment options, like Apple Pay, as a way to purchase products and services with cards stored in a phone’s digital wallet

Families who are already using these options enjoy this efficiency and convenience in other areas of their lives. Some families don’t understand the beauty of digital payments. But with the right guidance, your staff can alleviate those concerns and demonstrate the security and ease of use that comes from a digital payment platform.

How do districts implement a digital payment system?

Selecting the right digital payment system for your school district takes time and research.

Consider options that fit the specific needs of your staff and the community you serve. Look for vendors that provide other paperless services in addition to digital payments, so you can minimize the number of partners needed for your digital transformation.

Ensure your digital solutions make your staff, students, and families feel comfortable with the level of security provided. Only use options that comply with the Payment Card Industry Data Security Standards, also known as PCI compliance. Families are trusting you with their sensitive information, and insecure schools are primary targets for cybercriminals.

Learn more about the fundamental criteria to consider when looking for a K-12 student records technology partner from this guide to digital student records management.

Mobile payment systems benefit families and school district staff

Moving on and off-site transactions to a digital system streamlines district operations for staff members, and eliminates the struggle for families subjected to wasting precious time, energy, and money to complete paper-based tasks.

Digital alternatives also provide audit trails and greater security for all parties involved to enjoy. The bottom line is that your constituents are happier and more efficient with digital payment systems, ultimately contributing to your school district's success.

Recommended readings:

-

How Paperless Districts Are Good for Low-Income Communities

Want to learn more about the benefits of going paperless in school districts? Download our report today!